Fed rate hike

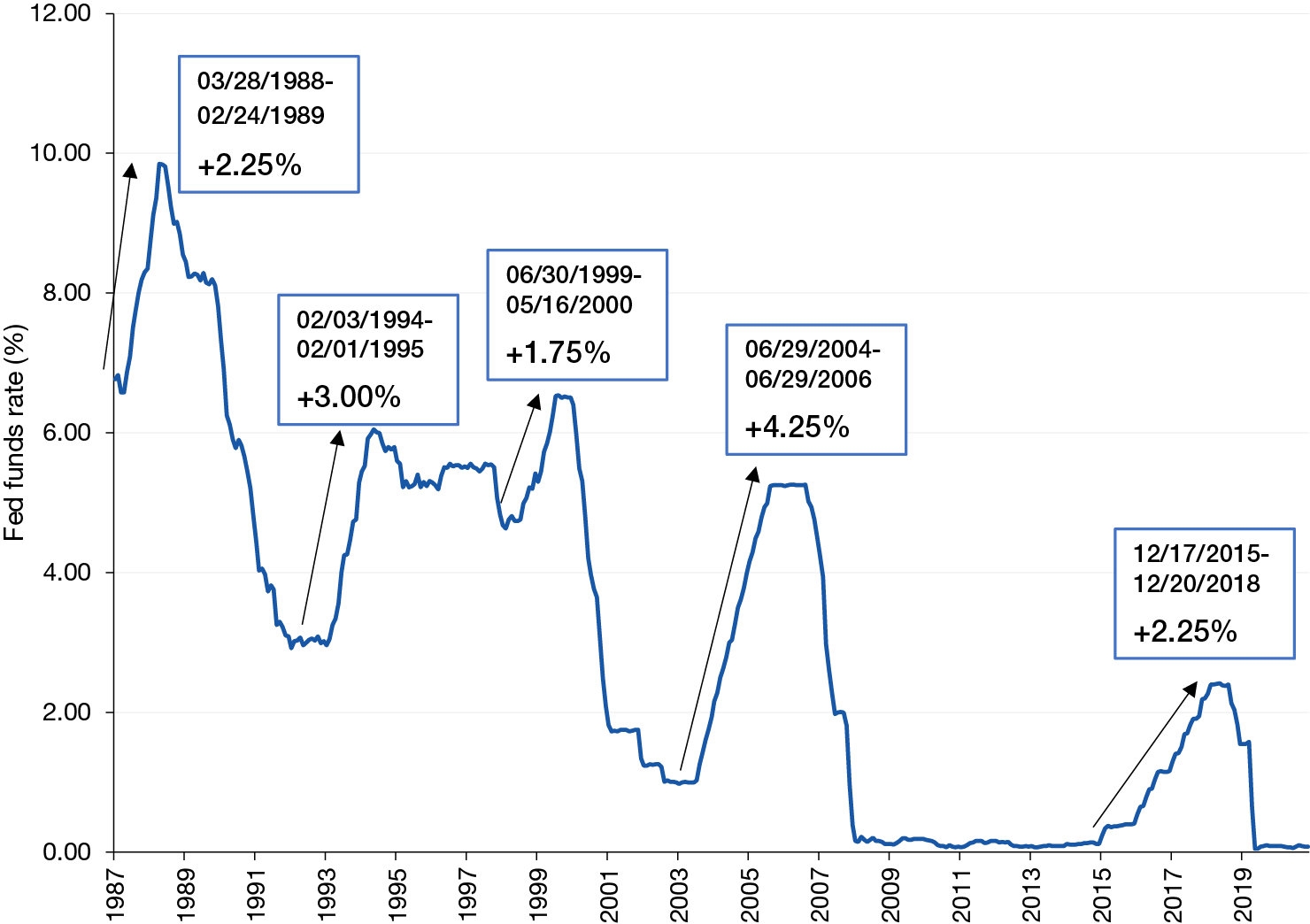

The Feds rate once soared to a target level as high as 20 percent in the early 1980s. The Fed has lifted its benchmark overnight interest rate by 225 points this year to a target range of 225 to 250.

By James Picerno - Sep 20.

. 23 hours agoThe federal funds rate projected for the end of this year signals another 125 percentage points in rate hikes to come in the Feds two remaining policy meetings in 2022 a level that implies. The bank expects the Fed to raise rates by 75 basis points in September before pivoting. Adjustable-rate loans such as ARMs that are no longer in the fixed-rate period and credit cards with variable rates often see higher interest rates when the Fed hikes their benchmark rate.

11 hours agoThe Federal Reserve on Wednesday raised its benchmark interest rate by 075 percentage point and signaled it plans to keep rates higher for longer as it tries to douse red-hot inflation. Chair Jerome Powell said there. The latest increase moved the Feds target range to.

The central bank is widely expected to hike rates next month by. That implies a quarter-point rate rise next year but no. Market pricing is for a half-point rate hike at the September meeting though that remains a close call.

Wednesdays rate increase of 075 percentage point is expected to reverberate through the economy driving up rates for credit cards home equity line of credit. Yet the Feds three-quarter point rate hike in July takes borrowing costs back to 2018 levels. Bond Market Fully Priced In Another 75 Bps Rate Hike.

11 hours agoThe rate-making Federal Open Market Committee hiked the benchmark interest rate by 075 percentage points at the end of a two-day meeting. The aggressive Fed Reserve rates hikes came after two years of keeping its benchmark funds rates flat at 025 between 2020 and 2021 to shore up the US economy during the Covid-19 pandemic. 11 hours agoFed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023.

The Federal Reserve on Wednesday enacted its second consecutive 075 percentage point interest rate increase taking its benchmark rate to a range of 225-25. The Federal Reserve raised the target range for the fed funds rate by 75bps to 225-25 during its July 2022 meeting the fourth consecutive rate hike and pushing borrowing costs to the highest level since 2019. What was the Fed rate hike today.

The new target range for fed funds is 225 to 250. Fed fund futures implied investors were pricing in a more than 81 chance of another supersized 75 basis-point interest rate hike. In 2018 two years before the pandemic the Fed had four rate hikes in March June September and December with a quarter-point increase each bringing its.

Federal Reserve officials on Tuesday reiterated their support for further interest-rate hikes to quell inflation with the influential chief of the New York Fed saying the central bank will. 14 hours agoThe Federal Reserve raised rates by three-quarters of a point and projected a more aggressive path ahead as it tries to bring down high inflation. The Feds next policy meeting is scheduled for Sept.

9 hours agoThe Federal Reserve delivered its third major rate hike in succession on Wednesday raising its target rate by 075 point which is the most aggressive tightening on record. The rate is at 225 to 250 after the Fed imposed hikes of 75 basis points at it last two meetings. According to CME Groups Fed tracker the most likely rate is another 75 bps hike placing the range.

A Fed Hike means that the voting members of the FOMC voted to increase its target for the key policy rate of the United States the US Target Federal Funds Rate known as the Fed Funds rate for short. A hike in the Fed Funds rate is one of the key monetary policy levers that the Central Bank has in its arsenal to slow down inflation by making it more expensive to borrow. For borrowers and consumers the fed rate hike means that many types of financing will cost more due to higher interest rates.

The Fed September FOMC meeting will produce one more outsized interest rate hike according to JPMorgan. The Federal Open Market Committee FOMC voted to increase the fed funds rate by 75 basis points at its meeting on July 26-27 2022. The Fed has now hiked rates by three-quarters of a percentage point for the second straight month with the previous 075 increase marking the first of its kind since 1994.

The Feds actions will increase the rate that banks charge each other for overnight borrowing to a range of between 225 to 250 the highest since December 2018. Meeting participants noted that the 225-250 range for the federal funds rate was around. 20 hours agoAnother big interest rate hike is coming as the Fed battles stubborn inflation The Federal Reserve is expected to raise interest rates by another 075 percentage points today as it tries to.

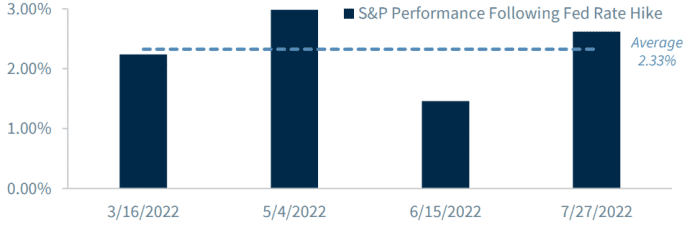

The SP 500 fell 17 percent as investors.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/IT4N4ITWX5P2VPYL2FZW63IQYE.png)

Analysis Hot Inflation Fuels Case For Big Bang Fed Rate Hike In March Reuters

Fed Raises Interest Rate Half A Percentage Point Largest Increase Since 2000 The New York Times

Which Assets Have Done Well During Fed Rate Hikes

Fed Rate Hikes Expectations And Reality Cme Group

Us Fed Raises Interest Rates To Fight 40 Year High Inflation World Economic Forum

Comments

Post a Comment